Understanding how to pay CIS (Construction Industry Scheme) tax online is essential for UK contractors who work with subcontractors. HMRC requires accurate monthly reporting and prompt payment of CIS deductions, and failing to meet deadlines can lead to significant penalties.

This guide explains everything contractors need to know about making CIS payments online: setting up your account, choosing payment methods, understanding deadlines, and avoiding fines.

Who Needs to Pay CIS Tax?

Under the CIS scheme, contractors are responsible for deducting tax from payments made to subcontractors and paying that tax to HMRC. If you are registered as a CIS contractor, you are required to:

- Verify the status of each subcontractor (registered or gross payment status)

- Deduct 20% or 30% from payments as required

- Submit a monthly CIS return detailing payments and deductions

- Pay the deducted tax to HMRC by the deadline

Subcontractors do not usually make CIS payments themselves, unless operating as a limited company eligible for CIS repayment offsets.

Registering and Setting Up Your Online CIS Account

Before you can make payments, you need access to HMRC’s online CIS system.

Step-by-step setup:

- Register as a CIS contractor via HMRC (if not already registered)

- Set up a Government Gateway account with administrator-level access

- Add PAYE for Employers to your account (CIS is managed under this area)

- Navigate to “Manage Taxes” and ensure PAYE & CIS is enabled

- Once set up, you’ll be able to:

- File CIS returns

- View liabilities

- Make payments directly to HMRC

Monthly and Quarterly CIS Payment Deadlines

HMRC requires CIS payments on either a monthly or quarterly basis, depending on your average liability.

Monthly Payment Deadlines:

- Paper or phone payments: by the 19th of each month

- Electronic payments: by the 22nd of each month

Example:

- Tax month: 6 April to 5 May

- Payment deadline: 19 May (paper), 22 May (electronic)

Quarterly Payments:

If your total monthly liability for CIS, PAYE, and National Insurance averages under £1,500, you may opt to pay quarterly.

Quarterly periods end on:

- 5 July

- 5 October

- 5 January

- 5 April

You must still file CIS returns monthly, even if you pay quarterly.

How to Pay CIS Online

Contractors can choose from multiple payment methods. All methods require your 13-digit Accounts Office Reference number, formatted like 123PA01234567.

1. Paying via Your HMRC Online Account

- Login through your Government Gateway

- Go to Manage Taxes > PAYE & CIS

- Select “Make a Payment”

- Follow instructions to pay using your chosen method

2. Paying by Bank Transfer

Use the HMRC bank details:

Account Name: HMRC Cumbernauld

Account Number: 12001039

Sort Code: 08-32-10

Reference: Your 13-digit Accounts Office Reference

Payments usually clear the same-day, but allow extra time before the deadline.

3. Paying by Debit or Credit Card

- Visit the HMRC Card Payment Portal

- Select “No, pay without signing in”

- Enter your 13-digit reference and card details

- Allow 2–3 days for processing

4. Direct Debit

Set up a direct debit from your HMRC account so payments are made automatically each month. Note that direct debits need to be in place before the due date.

If You Miss a CIS Payment Deadline

If you fail to pay on time, HMRC may issue a penalty based on how late the return or payment is:

| Time Late | Penalty |

| 1 day | £100 |

| 2 months | £200 |

| 6 months | £300 or 5% of the CIS liability (whichever is higher) |

| 12 months | £300 or 5% of the CIS liability (whichever is higher) |

| Over 12 months | Additional penalty up to £3,000 or 100% of the CIS due |

Pro tip: If no payments were due that month, notify HMRC to avoid penalties by filing a nil return online or by contacting them directly.

What to Do If You Disagree With a Penalty

You can appeal CIS penalties within 30 days:

- Online: via your Government Gateway under the penalty notice

- By post: send a written appeal including your UTR and reference number to HMRC

- Appeals cannot be made by phone.

Pro tip: Keep a record of your submission for reference.

Simplifying CIS Payment Workflows

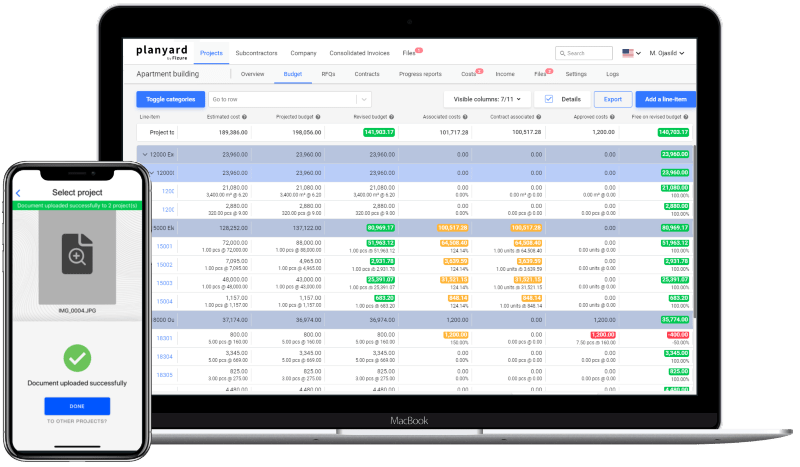

While HMRC allows you to submit and pay CIS returns through their portal, many contractors find it easier to use accounting platforms like Xero or QuickBooks that support CIS. When used in combination with construction-focused platforms like Planyard, you can reduce admin burden and ensure financial data aligns between field operations and compliance reporting:

- Review and approve subcontractor valuations

Manage valuations based on contract terms and site progress, reducing errors and disputes. - Sync approved costs with your CIS-enabled accounting software

Ensure consistency between what is approved by commercial teams and what is recorded in accounting and payroll systems. - Centralise budget tracking and subcontractor documentation

Maintain a single source of truth for contracts, variations, payment records, and budget performance, all in real time. - Maintain audit trails for HMRC compliance checks

Keep a complete and accessible record of financial approvals, payment histories, and cost breakdowns—essential for tax and CIS inspections. - Monitor committed and actual costs against project budgets

Identify cost overruns early by comparing committed spend (including subcontractor packages) with real-time progress and invoicing. - Streamline variation tracking

Record and manage all scope changes and their financial impact in one platform, linking changes directly to project budgets and subcontractor valuations. - Improve cost forecasting and margin visibility

Access live cost-to-complete forecasts and profitability metrics across all active projects, supporting better cash flow planning. - Facilitate collaboration between commercial and finance teams

Reduce data silos by connecting project-level approvals with back-office financial processes, making month-end reconciliation faster and more accurate.

Explore how Planyard can support your team — book a demo or try it free for 14 days.