Managing construction finances is a critical task for contractors. Every project comes with its own financial complexities, such as tracking budgets, managing invoices, and forecasting cash flow. QuickBooks has emerged as a go-to tool for construction accounting, offering features that simplify these processes.

While QuickBooks is versatile, understanding its full potential and limitations in construction-specific scenarios is essential. In this article, we explore how QuickBooks meets the needs of construction businesses and how additional integrations can further enhance its functionality.

What Makes QuickBooks Essential for Construction Businesses?

QuickBooks is widely recognized for its ability to manage general financial operations like payroll, invoicing, and tax preparation. It’s a powerful tool for contractors because it helps them organize and streamline processes that might otherwise require multiple tools.

For construction businesses, QuickBooks adds value through features like job costing and project profitability tracking. These tools make it easier to monitor financial health at both the project and portfolio levels. However, its flexibility also means it’s not fully specialized for construction, so users often need to configure it for their specific requirements.

Does QuickBooks Really Handle Construction Accounting?

QuickBooks can manage many tasks central to construction accounting, such as expense tracking, subcontractor payments, and job-specific profit margins. However, construction accounting involves additional nuances, like handling change orders and managing RFQs (Request for Quotations). These advanced workflows require extra customization or integrations, making QuickBooks a strong but incomplete solution.

Which Version of QuickBooks is Best for Construction?

QuickBooks offers multiple versions, each catering to different business sizes and complexities. Contractors should choose based on their specific needs, balancing functionality and ease of use.

Key QuickBooks Versions for Construction

| Version | Features | Ideal For |

|---|---|---|

| QuickBooks Online | Cloud-based, real-time updates, accessible from anywhere | Small to mid-sized contractors |

| QuickBooks Desktop Pro | Offline access, robust reporting, and detailed cost tracking | Businesses with complex reporting needs |

| QuickBooks Premier: Contractor Edition | Construction-specific tools like job costing, progress billing, and cost-to-completion reporting | Established contractors handling multiple projects |

The Contractor Edition is specifically designed for the construction industry. It helps businesses create detailed reports and track progress efficiently. However, QuickBooks Online is becoming increasingly popular for its integration capabilities and ease of use for on-the-go contractors.

Does QuickBooks Have a Contractor Version?

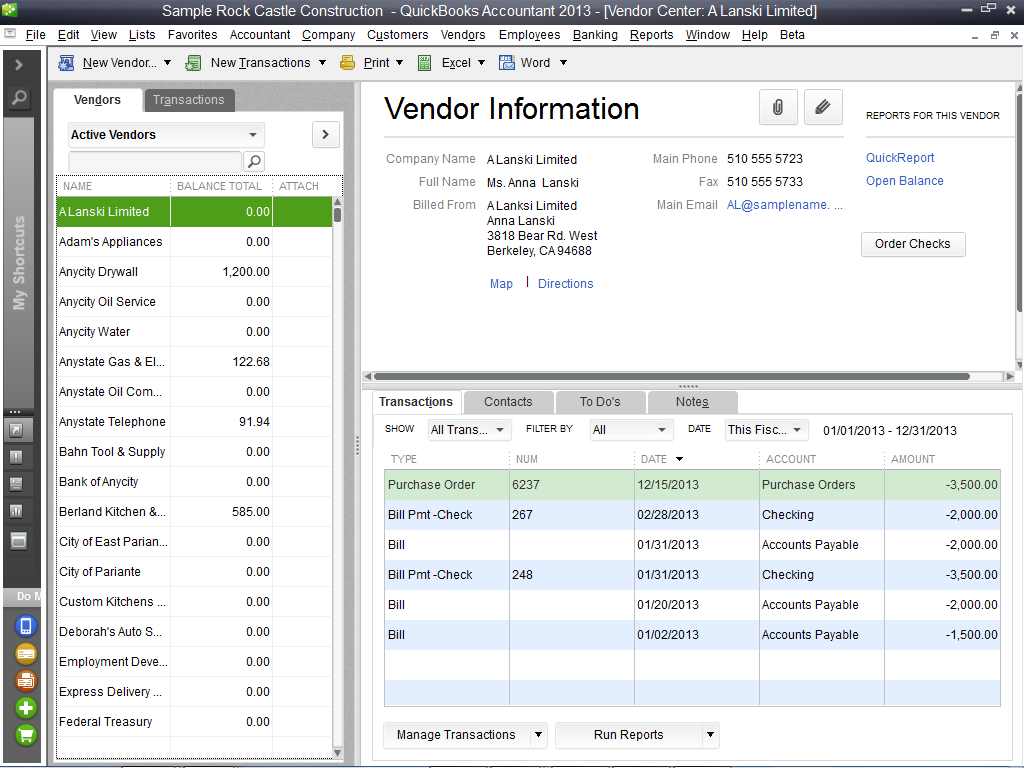

Yes, QuickBooks offers a dedicated Contractor Edition as part of its Premier Desktop product line. This version is tailored for construction businesses and includes features like estimating, job costing, and progress invoicing.

The Contractor Edition enables users to monitor project profitability more closely by providing detailed reports on job status, costs, and revenue. It also simplifies billing by allowing users to create progress invoices based on project milestones. However, while it excels in these areas, some contractors find that it lacks robust tools for managing subcontractors or forecasting cash flow.

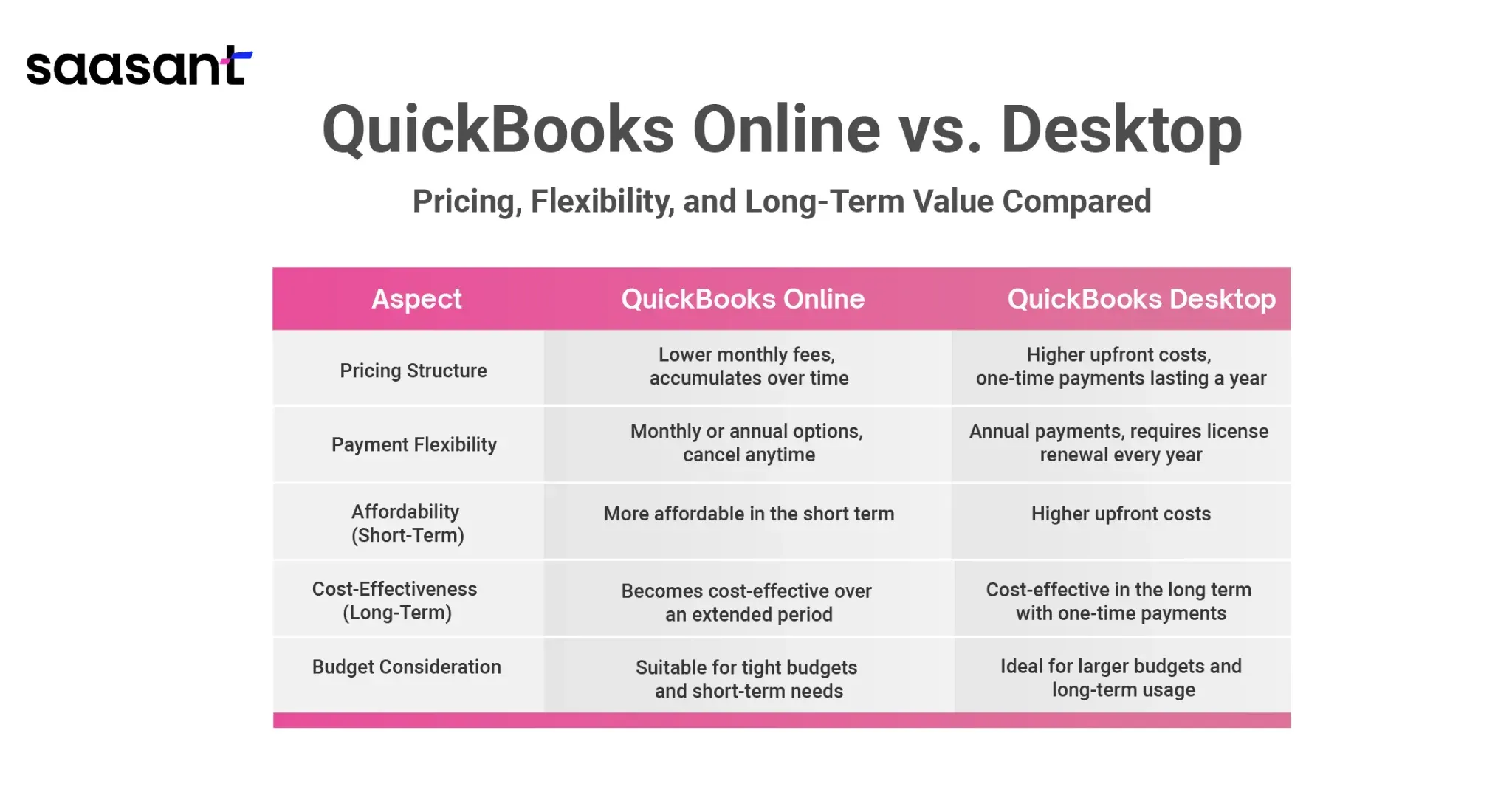

How Much Does QuickBooks Cost for Contractors?

The cost of QuickBooks varies by version and subscription type. Here’s a breakdown:

- QuickBooks Online: Subscription costs range from $35/month (or 14£/month) for the Simple Start plan to $235/month (or 90£/month) for the Advanced plan. Add-ons like payroll incur additional fees.

- QuickBooks Desktop Premier Contractor Edition: Starts at $1922/year, with occasional discounts available. This version includes the most construction-specific features.

For many contractors, these prices are a worthwhile investment, given the time and errors saved. However, additional costs may arise when integrating with third-party tools for enhanced functionality.

Common Challenges When Using QuickBooks for Construction Accounting

QuickBooks is a powerful tool, but like any software, it has its limitations. For construction companies with complex workflows, these challenges can sometimes hinder efficiency. Understanding these issues can help businesses find solutions and optimize their use of QuickBooks.

Managing Complex Subcontractor Payments

Handling payments for multiple subcontractors across different projects can be cumbersome. QuickBooks tracks expenses, but it doesn’t provide specialized features for managing retainage, change orders, or progress payments. Contractors often need manual workarounds, which can lead to errors or delays.

Limited Budget-to-Actual Tracking

While QuickBooks offers basic job costing, comparing real-time expenses to budgets isn’t seamless. Construction projects require dynamic budget tracking to account for unexpected costs or scope changes, which QuickBooks alone might not manage efficiently.

Handling Change Orders

Change orders are inevitable in construction projects. QuickBooks can record changes, but it lacks dedicated workflows to streamline approval processes and update budgets in real time. This can result in outdated financial data and cost overruns going unnoticed.

Learning Curve for Non-Accounting Professionals

Construction professionals like project managers or site engineers may struggle to use QuickBooks effectively. Its accounting-centric design, while robust, may not align with the workflow of field-based roles.

Integrations with Construction Tools

QuickBooks supports integrations, but setting up and managing them can be complex. If not properly configured, data discrepancies may arise between QuickBooks and other tools, creating inefficiencies instead of solving them.

QuickBooks for Small vs. Large Construction Businesses

QuickBooks is a flexible accounting tool, suitable for both small and large construction businesses. However, the approach to using QuickBooks varies based on business size. While small companies often rely on its out-of-the-box features, larger firms benefit from integrating QuickBooks with industry-specific solutions to address their complex workflows.

QuickBooks for Small Construction Businesses

Small construction businesses, such as solo contractors, often prioritize affordability and simplicity. QuickBooks Online is an ideal choice for them due to its modern, cloud-based functionality that eliminates the need for physical installations or complex setups.

Key Advantages for Small Businesses:

- Easy to set up and use without extensive accounting knowledge.

- Mobile-friendly, allowing contractors to access financial data on-site.

- Affordable subscription plans tailored to small business needs.

| Feature | Benefit for Small Businesses |

|---|---|

| Cloud Access | Manage finances from anywhere, on any device. |

| Invoicing | Quickly generate and send professional invoices. |

| Expense Tracking | Simplify categorization of project costs. |

| Basic Reporting | Access key insights to monitor income and costs. |

QuickBooks Online empowers small businesses to manage financial operations effectively without the overhead of complicated systems, ensuring ease of use and modern accessibility. Albeit not offering all of the functionality one might want.

QuickBooks for Larger Construction Businesses

Larger construction businesses face greater complexity, managing multiple projects, subcontractors, and extensive budgets. While QuickBooks Desktop Premier Contractor Edition offers powerful tools for advanced reporting and job costing, relying solely on an offline system is no longer a modern approach.

Today’s large businesses benefit most when QuickBooks is integrated with industry-specific solutions that provide enhanced functionality. For instance, pairing QuickBooks with project management software or construction-focused financial tools allows companies to handle detailed workflows like subcontractor payments, change order tracking, and dynamic budgeting.

Key Advantages of Integrating Solutions for Large Businesses:

- Enhanced data accuracy and real-time updates via cloud-based integrations.

- Automated workflows, reducing the risk of errors in job costing and invoicing.

- Comprehensive project tracking, combining QuickBooks’ accounting power with construction-specific features.

| Feature | Benefit for Large Businesses |

|---|---|

| Job Costing with Integration | Real-time tracking of costs by project or phase. |

| Change Order Management | Automatic budget updates and billing adjustments. |

| Reporting | Customizable, real-time insights across portfolios. |

| Subcontractor Payments | Streamlined approvals and retention management. |

For larger companies, the combination of QuickBooks and integrated solutions creates a connected system that supports scalability and reduces inefficiencies.

Why Relying Solely on Offline Systems is Outdated

Offline solutions like QuickBooks Desktop Premier may seem attractive due to their advanced features, but they lack the flexibility and connectivity required in today’s fast-paced construction industry.

Without cloud integration, data updates are delayed, collaboration becomes challenging, and errors can occur when syncing across tools manually. By integrating QuickBooks with modern, cloud-based industry tools, contractors can ensure real-time data access and streamlined operations that match the demands of their business.

The Need for Updates and the Risk of Discontinuation

As with any software, QuickBooks requires regular updates to maintain its functionality, security, and compatibility with modern tools. QuickBooks Desktop versions, including the Premier Contractor Edition, rely on periodic upgrades to keep features up to date. Without these updates, businesses may face performance issues or security vulnerabilities.

Additionally, Intuit has started phasing out certain older versions of QuickBooks Desktop, including discontinuing support for some products. This move emphasizes the growing shift towards cloud-based solutions like QuickBooks Online, which offer continuous updates without requiring manual upgrades.

For construction businesses, this highlights the importance of planning for the future by adopting tools that integrate seamlessly with QuickBooks Online or other modern software. Staying ahead of these changes ensures that businesses can avoid disruptions and take advantage of the latest features and improvements.

Why Planyard Complements QuickBooks for Construction Businesses

While QuickBooks is excellent for core accounting tasks, adding a specialized tool like Planyard can significantly enhance its capabilities for construction businesses. Planyard seamlessly integrates with QuickBooks to address construction-specific challenges that the software alone may not fully cover.

How Planyard Enhances QuickBooks

- Automated Budget Management: Planyard synchronizes project budgets with real-time financial data, automatically updating them as invoices or purchase orders are processed. This eliminates the need for manual data entry.

- Subcontractor Management: Planyard simplifies subcontractor payments, agreements, and tracking, ensuring everything is managed efficiently in one place.

- Real-Time Profitability Insights: Gain instant visibility into project finances, helping you make informed decisions quickly. Planyard also provides cash flow forecasts for better financial planning.

- Effortless Invoice Matching: Using advanced OCR technology, Planyard ensures invoices are automatically matched to the correct projects and line items, with all data synced to QuickBooks.

Planyard’s seamless integration ensures that QuickBooks users can manage their financial workflows more efficiently while maintaining complete control over construction-specific processes.

Choosing the Right QuickBooks for Your Business

For small construction businesses, QuickBooks Online provides the modern, accessible tools needed to manage finances efficiently. Large companies, however, should consider integrating QuickBooks with construction-specific solutions to enhance functionality and overcome the limitations of offline tools.

Adopting a connected approach ensures your business operates with up-to-date data, reduces manual errors, and provides the scalability required for long-term growth.

Summary

QuickBooks is a widely used accounting solution for construction businesses, offering tools for invoicing, expense tracking, and project profitability monitoring. Its flexibility makes it ideal for contractors of all sizes, but certain challenges can limit its efficiency.

Common hurdles include managing subcontractor payments, processing change orders, and maintaining real-time budget updates. These issues can lead to inefficiencies and missed opportunities to address financial risks before they escalate.

By adopting best practices such as regular financial reviews and detailed cost tracking, contractors can improve their workflows. Integrating QuickBooks with other tools can also enhance its functionality, making it easier to handle complex construction-specific tasks.

With the right approach, contractors can maximize QuickBooks’ potential to achieve better financial control, prevent budget overruns, and keep projects profitable.