Your chart of accounts tells your team what a cost is; Xero’s tracking tells you where it belongs. When those two are clear and concise, coding gets faster, project reports line up, and month-end stops feeling like detective work.

This guide walks through a lean, construction-ready COA—materials, subcontractors, plant hire, WIP, retentions, CIS—and how to map every line to projects and cost codes without bloating the ledger. If you want to see those accounts flow through purchasing, valuations, approvals, and into Xero, start with Job costing with 3-way match — costs hit the right budgets with no retyping and a clean audit trail.

The Xero view: what a chart of accounts is

In Xero, your chart of accounts (COA) is the list of GL accounts used to post every transaction—grouped into assets, liabilities, equity, revenue, and expenses. Think of it as the map that ensures transactions land in the right place on your financial statements.

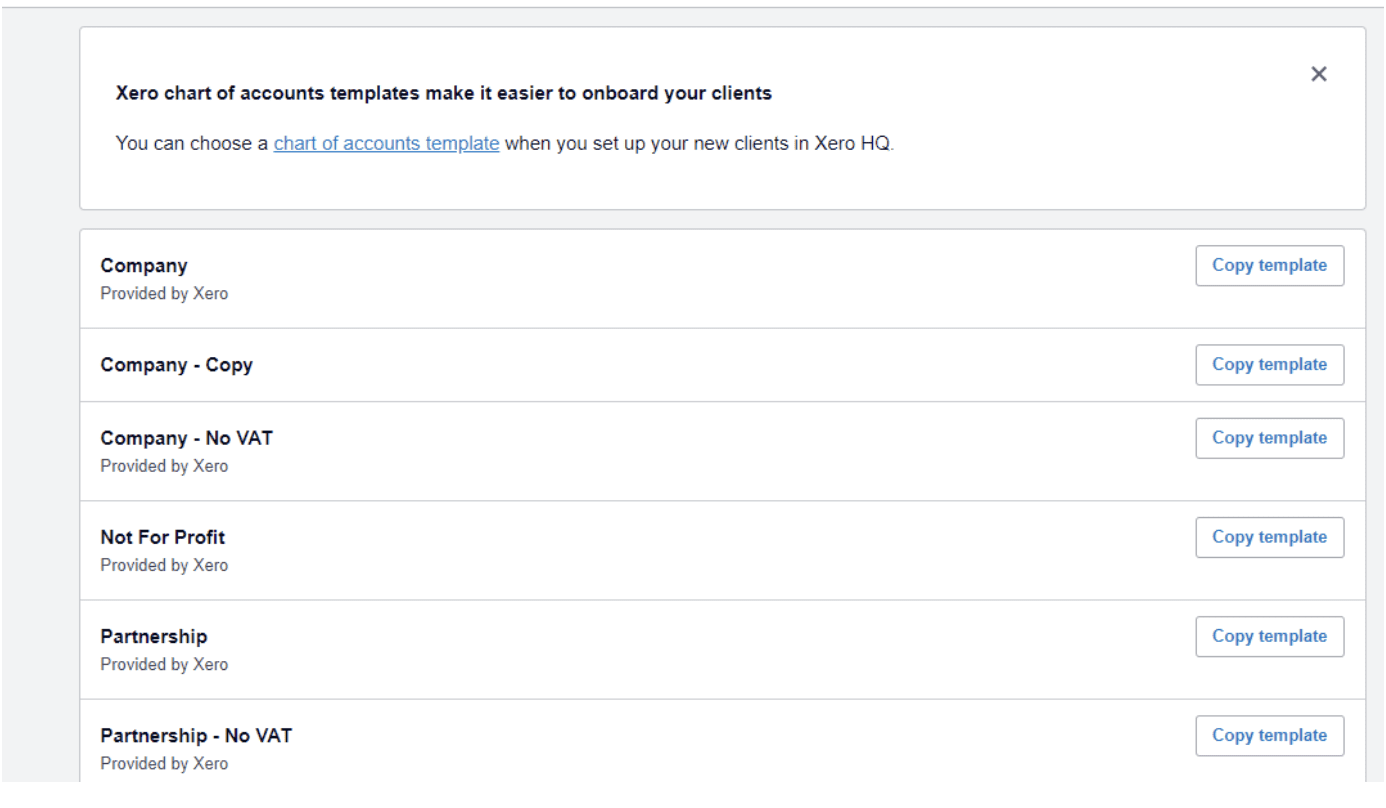

Each account has an account type (e.g., Direct Costs, Overhead, Fixed Asset), and that type controls where the balance appears in reports. If you manage several entities, advisors can start from Xero HQ templates and export/import a standardised COA as CSV.

Why construction teams should keep the COA lean

- Faster coding, fewer errors. Short, clear accounts help coders pick the right bucket consistently; the account type handles the report placement.

- Separate “what” from “where.” Use the GL account to describe what the spend is (materials, subcontractors, hire). Use project dimensions to describe where it belongs (project/cost code). In Xero, tracking categories add those dimensions without exploding the COA. You can create up to four categories in total, but only two can be active at once; Xero recommends ≤100 options per category for performance.

How to structure a construction COA in Xero (practical blueprint)

1) Define the core expense lines (the “what”)

Keep a compact set you’ll use weekly: Materials, Subcontractors, Plant & Equipment Hire, Direct Labour/Wages, and a small set of site overheads (utilities, consumables, welfare). Add WIP, accruals/prepayments, or retentions only if you actually operate them in-ledger; pick the correct account type so reporting behaves as expected.

2) Map to projects & codes (the “where”)

Create two tracking categories—commonly Project and Cost Code—then add options to each. On every bill line, select the GL account (e.g., Subcontractors) and tag Project + Cost Code. Later, filter the P&L by project, code, or both. (Two active categories; keep each to ≤100 options.)

3) Decide if you also want Xero Projects

Xero Projects is Xero’s light job module for time and expenses with project profitability and project-specific reports. It links bills and spend money to jobs, but note that other (ledger) reports don’t pull from Projects—use Projects reports for those views. Many contractors run tracking for ledger-wide reporting and add Projects when they also need time/expense workflows.

4) Use software like Planyard to enforce the coding upstream

Map your Xero GL accounts and tracking categories (Project + Cost Code) to budget lines in Planyard. Capture invoices via OCR, run a 3-way match (PO/subcontract ↔ delivery/valuation ↔ invoice), and enforce line-level account + tracking before anything posts.

Only approved, fully coded bills sync to Xero (supplier, account, tracking, tax, and attachments included). Result: your COA stays lean, project coding stays consistent, and ledger reports mirror what site teams actually approved.

Xero setup: from blank to ready (quick steps)

- Start from a template (optional, advisors). In Xero HQ, choose a chart-of-accounts template for the client, customise, and export/import as CSV. This keeps naming and account types consistent across entities.

- Create tracking categories. Go to Accounting → Advanced → Tracking categories; add Project and Cost Code, then load your options. Keep lists tidy and archive closed projects to maintain performance.

- Train line-level coding. The value comes from coding each line with an account and both tracking tags; that’s what enables accurate P&L by project and code.

- Tie in POs cleanly. When you create POs in Xero, you can add tracking for convenience; the PO itself doesn’t appear in the tracking summary and remains off-ledger until converted to a bill—coding it helps the bill inherit the right tags.

Example starter template (adapt, don’t bloat)

VAT defaults used

- Balance sheet → No VAT

- Direct costs/overheads → 20% (VAT on Expenses)

- Revenue → 20% (VAT on Income)

- Wages/Depreciation/Bank charges → No VAT

Balance sheet

Current assets (101–109)

- 101 Bank – Current; 102 Petty Cash — operating cash.

- 103 Retentions Receivable — client holdbacks tracked separately for cash forecasting.

- 104 Notes Receivable — short loans due to you.

- 105 Prepayments — insurance, rent, software paid in advance.

- 106 Work in Progress (WIP) — delivered/certified but not yet billed; smooths timing.

- 107 Accrued Income — earned not yet invoiced.

- 108 CIS Suffered (Receivable) — CIS withheld by customers to reclaim.

- 109 Other Current Assets — catch-all you should rarely need.

Non-current assets (111–117)

- 111 Land; 112 Buildings — property.

- 113 Construction Equipment; 114 Vehicles — owned plant/vehicles (not hire).

- 115 Office Furniture & Equipment — office kit.

- 116 Accumulated Depreciation (contra).

- 117 Other Non-current Assets — deposits/long-term items.

Current liabilities (201–208)

- 201 Trade Creditors – Other — non-AP sundry creditors (leave Xero’s system AP alone).

- 202 Retentions Payable — amounts you withhold from subcontractors.

- 203 Short-term Loans; 206 Accrued Expenses — timing clean-up.

- 204 Accrued Payroll; 205 Taxes & Duties Payable — PAYE/NIC etc.

- 207 CIS Deductions Payable — CIS withheld to remit to HMRC.

- 208 Other Current Liabilities — rarely used.

Non-current liabilities (211–215)

- 211 Bonds Payable; 212 Long-term Loans; 213 Deferred Compensation; 214 Deferred Income; 215 Pension Liabilities.

Equity (301–305)

- 301 Capital Introduced; 302 Retained Earnings; 303/304 Share Capital; 305 Other Reserves.

Income

Revenue/other income (401–404)

- 401 Contract Income — main construction revenue.

- 402 Variations & Change Orders — approved changes (or tag with cost codes if you prefer fewer revenue lines).

- 403 Hire & Rebill Income; 404 Other Operating Income.

Costs (the weekly workhorses)

Direct costs (501–504, 5106/5107 for timing)

- 501 Materials — permanent materials in the works.

- 502 Direct Labour (Site) — your site team (No VAT).

- 503 Subcontractors — trade packages; aligns with CIS.

- 504 Plant & Equipment Hire — hired-in plant/access/scaffold (separate from owned kit).

- 510 Work in Progress (WIP) and 107 Accrued Income handle period-end timing.

Overheads and other expenses (505–523)

- 505 Salaries & Wages (Office) — keep separate from 502 for clean job margins.

- 506 Repairs & Maintenance; 513 Depreciation Expense — for owned assets.

- 507 Insurance, Rates & Licences; 516 Site Utilities; 517 Site Accommodation & Welfare; 518 Waste & Skips; 519 Quality & Testing.

- 511 IT & Software; 514 Telephone & Internet; 509 Office Supplies; 510 Office Rent; 520 Professional Fees; 521 Travel & Subsistence; 522 Bank Charges; 523 Training & Certification.

- 512 Small Tools & Consumables — hand tools, PPE, fixings.

Why this structure works

It keeps the COA lean while covering construction realities: retentions, CIS, WIP, hired vs owned plant, and site overheads. You get clean financials without hundreds of near-duplicate accounts.

How to use it in Xero (quick rules)

- Post the “what” to the GL account, then tag the “where” on every bill line using Tracking Categories: Project + Cost Code.

- Keep retentions out of revenue/costs—use the receivable/payable lines for clarity.

- Use WIP/Accrued Income at month-end to align costs and income with certifications.

- Separate Direct Labour (Site) from Salaries & Wages (Office) to keep project gross margins true.

- Hired plant → 504; owned plant costs → depreciation/repairs (506/513).

Tracking vs Xero Projects (when to use which)

Both live inside Xero, but they solve different problems. Tracking categories add reporting dimensions to your ledger. Xero Projects adds a light job workflow for time/expenses and basic profitability. Most construction teams use tracking for ledger-wide reporting and add Projects only where time-entry is needed.

| Tracking categories | Xero Projects | |

|---|---|---|

| Primary role | Ledger tagging & slicing | Job workflow & profitability |

| Where it shows | All ledger reports (filtered) | Projects module reports only |

| Data entry | Tag each bill line | Link bills, log time/expenses |

| Reporting scope | P&L by project/code | Job margin, WIP-style views |

| Time & expenses | Not included | Built-in timers & expenses |

| PO/bills focus | Coding accuracy, two tags | Basic spend against a job |

| Dimensions/scale | Two active categories | One job layer + tasks |

| Setup effort | Low; define tags | Moderate; set up jobs/tasks |

| Best for | Ledger-wide project/cost-code reporting | Teams billing time & materials |

| Works together | Use tags + Projects | Use Projects + tags on bills |

Rule of thumb: keep the COA lean, use Tracking (Project + Cost Code) for financial reporting, and add Projects only if you need time/expense capture and a simple job-profit view.

Where Planyard fits: It makes Tracking/Projects accurate by enforcing 3-way match upstream and mapping each line to your Xero GL account and tracking tags. Only approved, fully coded bills are then published to Xero.

Common pitfalls (from a Xero perspective)

- Hundreds of near-duplicate accounts. Fix by pruning the COA and shifting detail to Project/Cost Code tracking.

- Header-level coding only. Ensure line-level account + tracking on bills so project reports balance.

- Expecting POs to show in tracking/GL. They won’t until converted to a bill; code POs to save time and keep references, then convert when approved.

- Using Projects as a full ledger dimension. Use Projects for time/expenses and project profitability; rely on tracking for ledger-wide slicing.

Where this connects to live job costing

A lean Xero COA with disciplined tracking makes ledger reports trustworthy. But real control happens before bills hit the ledger—RFQs, POs/subcontracts, progress valuations, 3-way match, and approvals—so only approved, fully coded bills are sent to Xero.

Planyard is the construction-side layer that runs those steps, maps every line to your Xero GL accounts and tracking tags, and syncs only clean, approved bills—giving you live commitments, accurate forecasts, and a full audit trail without spreadsheets or retyping.